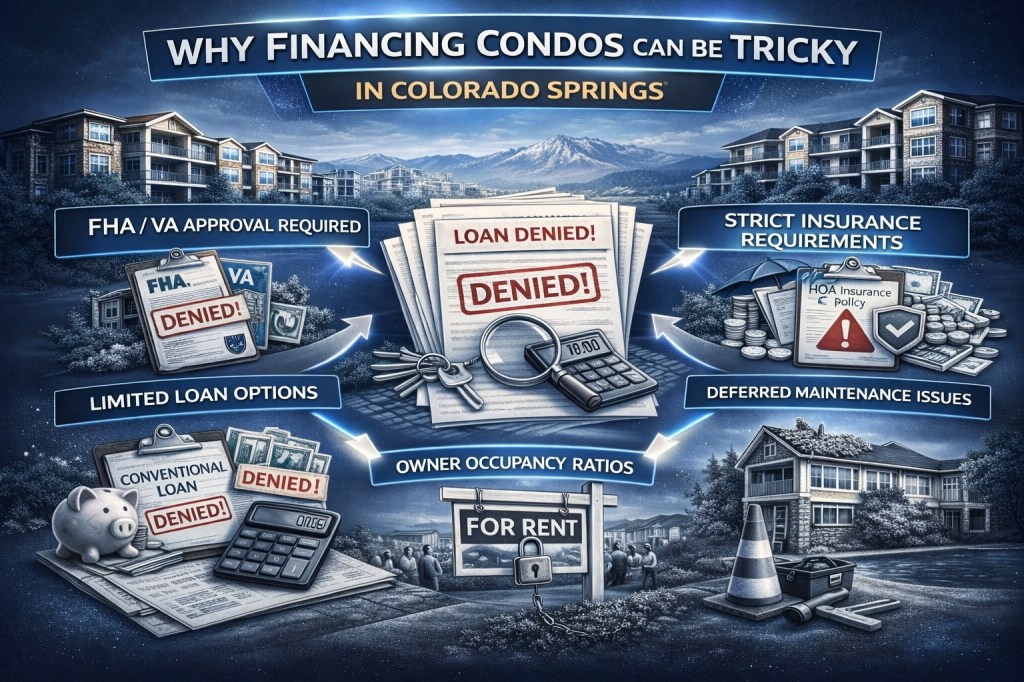

Condos can look like the perfect solution in Colorado Springs. Lower purchase prices, less maintenance, and great locations near downtown or major corridors. But many buyers are surprised to learn that finding the right loan for a condo can be more complicated than financing a single-family home.

The challenge usually isn’t the buyer. It’s the building.

Understanding why condo financing works differently can save buyers time, frustration, and last-minute deal issues.

Condos Are Approved as a Project, Not Just a Property

One of the biggest differences in condo financing is that lenders don’t only evaluate the buyer and the unit. They also evaluate the entire condo project.

This means the HOA’s finances, insurance, occupancy rates, and governance all come into play. A buyer can have excellent credit, strong income, and a solid down payment and still be unable to secure financing if the condo association doesn’t meet lender guidelines.

In Colorado Springs, where many condo buildings are older or self-managed, this is a common hurdle.

HOA Financial Health Matters More Than Buyers Expect

Lenders want to see that an HOA is financially stable. Red flags include low reserve balances, frequent special assessments, or budgets that rely heavily on future dues increases.

If an HOA doesn’t have enough money set aside for major repairs like roofing, siding, or structural components, lenders see higher risk. That risk can result in loan denial or limited financing options.

This is especially common in older condo communities near Downtown Colorado Springs and central Colorado Springs, where buildings may be decades old and maintenance costs are rising.

Owner-Occupancy Ratios Can Kill Financing

Many loan programs require a minimum percentage of owner-occupied units. If too many units are rentals, the project may no longer qualify for certain types of financing.

This is a big issue in Colorado Springs condo communities where investors purchased units during past market cycles and held onto them as rentals.

Even if rentals are allowed by the HOA, lender requirements still apply. A condo can be legally rentable but financially difficult to sell.

FHA and VA Condo Approval Is Not Automatic

First-time buyers often assume FHA or VA loans are widely available for condos. In reality, the condo project itself must be approved.

If a condo complex is not FHA- or VA-approved, buyers using those loan types may not be able to purchase there unless a spot approval is possible. Spot approvals are more limited than they used to be and still require the HOA to meet certain criteria.

This can significantly narrow options for buyers relying on FHA or VA financing, even when the price point looks attractive.

Insurance Requirements Have Become Stricter

Insurance is another major factor in condo financing. Lenders require the HOA to carry adequate master insurance coverage, including property and liability insurance.

In Colorado Springs, increased insurance costs related to hail, wind, and wildfire risk have made coverage more expensive and harder to obtain. Some HOAs carry high deductibles or limited coverage, which can impact loan approval.

Buyers often don’t realize insurance is an issue until late in the process, which can delay or derail a transaction.

Deferred Maintenance Raises Red Flags

Lenders don’t like deferred maintenance, especially when it involves structural components. Issues like aging roofs, deteriorating siding, or unresolved drainage problems can cause financing problems.

Inspection reports and HOA meeting minutes often reveal whether maintenance is being postponed due to lack of funds. If major repairs are planned but not funded, lenders may require additional documentation or deny financing altogether.

Loan Options Can Be More Limited

Because of these factors, condo buyers may have fewer loan options than buyers of single-family homes. Some lenders simply won’t finance certain condo projects.

This doesn’t mean condos are impossible to finance, but it does mean buyers need to be flexible and prepared. Larger down payments or different loan programs may be required.

Working with lenders experienced in condo financing can make a huge difference. They know which questions to ask early and which projects are more likely to qualify.

Why Local Knowledge Matters

Colorado Springs has a wide mix of condo communities, from newer developments to older complexes with unique structures. Financing challenges can vary dramatically from one building to another.

Local professionals who understand condo trends, HOA health, and lender requirements can help buyers avoid wasting time on properties that won’t qualify for their loan type.

For HOA governance and consumer protections, buyers can review resources from the Colorado HOA Information and Resource Center and the Colorado Division of Real Estate.

Utilities and Ongoing Costs Still Matter

Even when financing works, buyers should understand ongoing costs. Most condo owners still rely on Colorado Springs Utilities for electricity, gas, water, and wastewater, though some services may be partially included in HOA dues.

Knowing what’s included versus what’s separate helps buyers budget realistically, especially when HOA dues are higher.

How Buyers Can Avoid Surprises

Condo buyers in Colorado Springs can protect themselves by:

Asking early whether a condo is FHA, VA, or warrantable

Reviewing HOA financials and insurance before making an offer

Working with lenders experienced in condo financing

Being flexible on loan type or down payment if needed

These steps can prevent heartbreak after falling in love with a unit that isn’t financeable.

Final Thoughts

Condos remain an important part of the Colorado Springs housing market, offering affordability and convenience in great locations. But financing them isn’t as straightforward as many buyers expect.

The key isn’t avoiding condos. It’s understanding how financing works, why buildings matter as much as buyers, and how to plan ahead.

When buyers go in informed and prepared, condo financing challenges become manageable rather than deal-breaking. And that knowledge can make the difference between a smooth closing and a frustrating surprise at the finish line.

Leave a comment