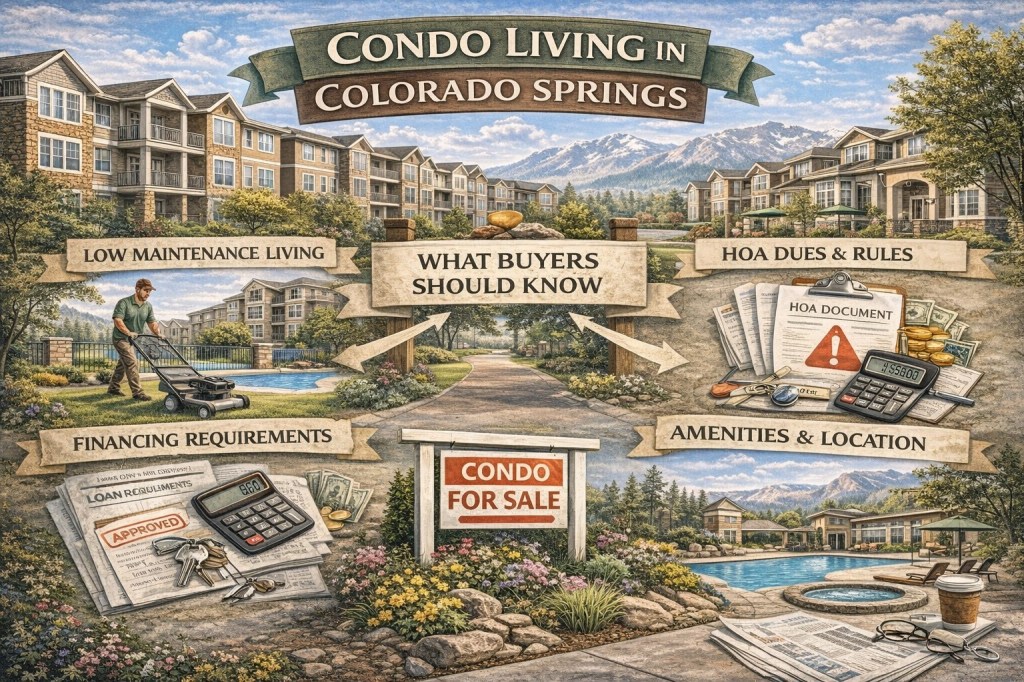

Condo living in Colorado Springs appeals to a wide range of buyers, from first-time homeowners and downsizers to people who want a low-maintenance lifestyle close to amenities. But condos work differently than single-family homes, especially in this market. Understanding how condo ownership functions locally can help buyers decide whether it’s a great fit or a frustrating mismatch.

Colorado Springs has a diverse condo inventory, from older downtown buildings to newer developments near major corridors. Each comes with its own trade-offs.

What Condo Living Really Means

When you buy a condo, you own the interior of your unit and share ownership of common areas with other residents. Those common areas may include roofs, exterior walls, parking areas, landscaping, hallways, elevators, and amenities like pools or fitness rooms.

This shared ownership structure is managed by a homeowners association, which sets rules, collects dues, and handles maintenance. In Colorado Springs, condo HOAs tend to be more involved than those for single-family neighborhoods because they manage essential building components.

Where Condos Are Most Common in Colorado Springs

Condos are most often found near higher-density areas and established corridors. You’ll see a concentration of condos near Downtown Colorado Springs, Old Colorado City, and along major routes like Academy Boulevard and Union Boulevard.

Many buyers are drawn to condos near downtown because of walkability and proximity to restaurants, entertainment, and work centers. Others prefer quieter condo communities that offer easy access to shopping and medical services without the upkeep of a detached home.

The Pros of Condo Living

Lower Maintenance Responsibilities

One of the biggest advantages of condo living is reduced maintenance. Exterior upkeep, roofing, snow removal, landscaping, and common utilities are often handled by the HOA. This can be especially appealing for buyers who travel frequently, don’t want to manage repairs, or prefer predictable monthly expenses.

Affordability Compared to Single-Family Homes

In many cases, condos offer a lower purchase price than single-family homes in similar locations. For first-time buyers, this can be an entry point into homeownership without the higher price tag of detached properties.

Location and Convenience

Condos are often located near amenities, public transportation, and employment centers. For buyers who value convenience and shorter commutes, condo living can be a strong lifestyle fit.

Amenities Without Individual Upkeep

Some condo communities offer amenities like pools, clubhouses, or secured entry. These features are shared and maintained collectively, rather than individually.

The Cons Buyers Should Consider

HOA Dues and Assessments

Condo HOA dues are typically higher than those for single-family homes because they cover more services. Buyers should understand exactly what the dues include and review the HOA’s financial health carefully.

Special assessments are also more common in condo communities, especially older buildings that need major repairs like roof replacement or structural updates.

Rules and Restrictions

Condos often come with stricter rules. These may include limits on rentals, pets, renovations, or even how units are used. Buyers who want flexibility should review governing documents closely.

Noise and Privacy

Shared walls, floors, and ceilings mean noise travels more easily. Building construction quality varies widely across Colorado Springs, and this can significantly impact day-to-day comfort.

Financing Can Be More Complex

Not all condos qualify for all loan types. FHA, VA, and some conventional loans have specific approval requirements for condo projects. This can affect buyer options and resale flexibility later.

Why HOA Health Matters Even More for Condos

In condo communities, HOA health is critical. The association is responsible for maintaining the structure of the building, not just cosmetic features.

Buyers should pay close attention to reserve balances, recent inspections, maintenance schedules, and insurance coverage. An underfunded HOA or deferred maintenance can lead to costly assessments and financing challenges.

For oversight and consumer guidance, buyers can review resources from the Colorado HOA Information and Resource Center and the Colorado Division of Real Estate.

Insurance and Utilities in Condo Living

Condo insurance works differently than single-family coverage. Owners typically carry an HO-6 policy that covers interior elements, while the HOA insures the structure and common areas. Understanding where responsibility begins and ends is essential.

Most condo owners still use Colorado Springs Utilities for electricity, gas, water, and wastewater, though some utilities may be partially included in HOA dues depending on the community.

Maintenance and Landscaping Considerations

Even though condos are low maintenance, they are not no maintenance. Interior repairs, appliances, and certain fixtures remain the owner’s responsibility.

Local businesses like Phelan Gardens and Rick’s Garden Center are often used by HOAs and condo owners for plant selection, irrigation guidance, and seasonal updates that comply with community standards.

Who Condo Living Works Best For

Condo living tends to be a great fit for:

First-time buyers looking for affordability

Downsizers wanting less physical upkeep

Buyers who value location and convenience

People who prefer predictable monthly costs

It may be less ideal for buyers who want rental flexibility, outdoor space, or full control over their property.

Questions Condo Buyers Should Always Ask

Before purchasing a condo, buyers should review:

What HOA dues include and how often they increase

Reserve balances and upcoming major repairs

Rental, pet, and renovation restrictions

Insurance coverage and deductibles

Loan eligibility for the specific condo project

These details matter more in condos than almost any other property type.

Final Thoughts

Condo living in Colorado Springs can be a smart, convenient, and affordable option when expectations align with reality. The key is understanding how shared ownership works, how the HOA is managed, and whether the community fits your lifestyle and long-term plans.

A well-run condo community can simplify homeownership and offer excellent value. A poorly managed one can create stress and unexpected costs.

As with any real estate decision, the best outcomes come from asking the right questions early and understanding what you’re buying into before closing.

Leave a comment