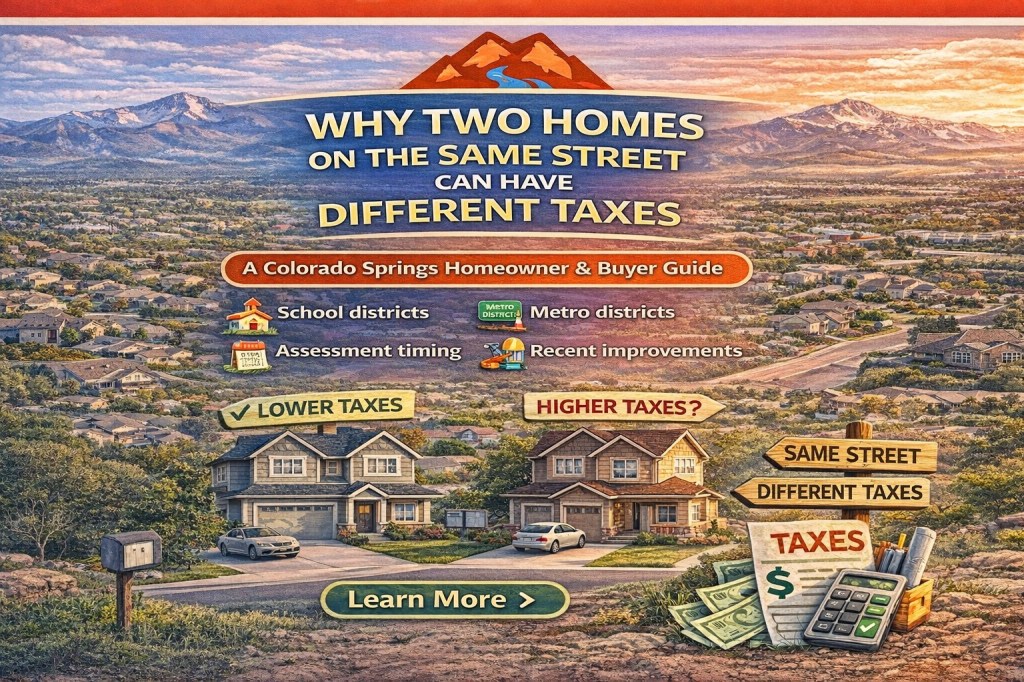

A Colorado Springs Homeowner & Buyer Guide

It’s one of the most common (and confusing) questions homeowners ask:

“Why does my neighbor pay less in property taxes when our homes look almost identical?”

In El Paso County, property taxes are not based on vibes, favoritism, or who planted nicer flowers. They’re driven by a combination of value, timing, and location-based factors that can vary even on the same street.

Let’s break this down simply, so you know what actually affects your tax bill and why comparisons aren’t always apples to apples.

Property Taxes Start With Assessed Value

The first piece of the puzzle is your home’s assessed value, which is determined by the El Paso County Assessor.

The Assessor estimates market value using:

- Recent comparable sales

- Property size and features

- Location and neighborhood data

- Condition (as reported or appealed)

Even two similar homes can have different assessed values if:

- One was updated and one wasn’t

- One sold recently at a higher price

- One has a finished basement, extra garage space, or lot differences

That value is then multiplied by the residential assessment rate, which is set by Colorado law and can change over time.

Timing Matters More Than Most People Realize

Colorado reassesses property values every two years, based on sales data from the prior 18-month period.

That means:

- A home purchased recently may reflect a higher market value

- A long-time owner may still be taxed on an older, lower valuation

- Two homes side by side can be in different “valuation moments”

This is one of the biggest reasons tax bills differ on the same street, especially in appreciating neighborhoods.

School Districts Can Split a Street

Yes, this happens more often than people expect.

School district boundaries don’t always follow street lines. Two neighboring homes can be assigned to different school districts, and school districts make up a large portion of a property’s mill levy.

Different district = different tax rate = different tax bill.

Metro Districts & Special Taxing Districts

Newer developments in Colorado Springs often include metro districts or other special taxing districts used to fund:

- Roads

- Utilities

- Parks

- Infrastructure

If one home is inside a metro district and another just outside it, taxes can vary significantly, even if the homes look identical.

Metro district taxes often decrease over time, but early years can be noticeably higher.

City Limits vs. County Properties

Another common split:

- One home inside Colorado Springs city limits

- One home technically in unincorporated El Paso County

City services, fire districts, and local improvements all affect mill levies. Crossing an invisible boundary can change taxes without changing your mailing address or ZIP code.

Improvements, Permits, and Updates

If a homeowner pulls permits for additions, remodels, or finished spaces, that information can impact assessed value.

Examples:

- Finished basements

- Added square footage

- Converted garages

- Major renovations

Meanwhile, a neighboring home without updates may retain a lower valuation.

How the Tax Bill Is Actually Calculated

Once value and districts are set, taxes are calculated and billed by the El Paso County Treasurer.

You can view tax details, payment history, and due dates at:

👉 https://treasurer.elpasoco.com

To review assessed values and property characteristics, homeowners can visit:

👉 https://assessor.elpasoco.com

These tools are especially helpful when comparing homes or planning a purchase.

Why This Matters in Real Estate

For buyers:

- Taxes shown in listings are based on the current owner’s situation

- A new purchase price may trigger higher taxes after reassessment

- Comparing tax bills between homes requires context

For sellers:

- Buyers often notice tax differences quickly

- Being able to explain why builds confidence

- Transparency helps avoid surprises after closing

Understanding these differences upfront prevents frustration later.

Can You Appeal If Taxes Seem Too High?

Yes. Homeowners can appeal their assessed value during the official appeal window if they believe it’s inaccurate.

Appeals are based on:

- Comparable sales

- Property condition

- Data accuracy

They’re not based on affordability or neighbor comparisons alone.

Final Thoughts

Two homes on the same street can share a view, a sidewalk, and a mailbox cluster and still have very different tax bills. Property taxes are shaped by value, timing, boundaries, and districts, not just appearances.

Once you understand the moving pieces, those differences make a lot more sense. And in real estate, clarity is always better than confusion.

If you ever want help reviewing a property’s tax history, understanding district boundaries, or estimating future taxes before buying, I’m always happy to help explain it clearly without the fine print headache.

Leave a comment