Flood zones sound scarier than they usually are. In Colorado Springs, they’re really just a way to describe how likely flooding is in a specific area and what that means for insurance, building rules, and peace of mind. Let’s break it down in plain English.

What Is a Flood Zone?

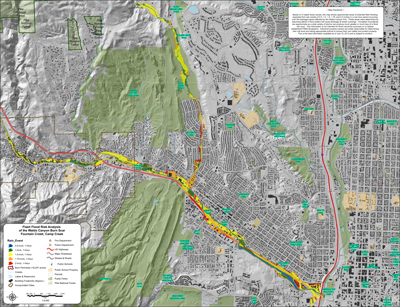

Flood zones are classifications created by FEMA that show the probability of flooding for a specific property. These zones appear on FEMA Flood Insurance Rate Maps (FIRMs) and are used by lenders, insurers, builders, and real estate professionals.

You can view official flood maps directly from FEMA here!

Flooding in Colorado Springs is typically tied to creeks, drainage corridors, snowmelt, and heavy rain, not coastal storms. No beachfront property jokes required.

The Main Flood Zones You’ll See (Decoded)

Here are the most common zones buyers and sellers encounter:

Zone X (Low Risk)

This is the low-drama zone.

- Minimal flood risk

- Flood insurance not required by most lenders

- Many Colorado Springs neighborhoods fall here

Flood insurance is optional in Zone X, and often surprisingly affordable. Bonus peace of mind, minimal monthly cost.

Zone AE (Higher Risk)

This zone gets the most attention.

- 1% annual chance of flooding (the “100-year floodplain”)

- Flood insurance usually required with a mortgage

- Development and remodel restrictions may apply

Homes near Fountain Creek, Monument Creek, and established drainage corridors often fall into this category.

Zone A

Similar to AE, but with fewer elevation details.

- Flood insurance typically required

- Further evaluation is often recommended

Why Flood Zones Matter in Real Estate

Flood zones can affect:

- Whether flood insurance is required

- Insurance premiums

- Future improvements or additions

- Buyer comfort level and negotiations

Important reminder: Being in a flood zone does not mean a home floods regularly. Many properties in Zone AE have never experienced flooding. The designation reflects risk, not history.

Do You Need Flood Insurance?

It depends on the zone and the loan type.

- Zone AE or A + mortgage = usually required

- Zone X = optional, but often smart

- Flood insurance covers things standard homeowners insurance does not (water entering from outside)

According to FEMA, more than 20% of flood claims come from low-risk zones. Translation: water doesn’t read maps.

For flood insurance options, many buyers work with local insurance professionals who understand Colorado-specific risks. A few well-known local agencies include:

- Lighthouse Insurance Group

- State Farm Insurance offices with flood-certified agents

How to Check a Property’s Flood Zone

Reliable local and national tools include:

The City’s stormwater page is especially helpful for understanding local drainage patterns, detention ponds, and mitigation projects that don’t always show up clearly on national maps.

Local Inspections & Expert Help

If flood risk is a concern, inspections matter. Local inspection companies familiar with our soils, drainage, and foundation conditions can provide valuable insight.

Trusted local options many buyers use is:

They frequently evaluate grading, drainage, and moisture-related concerns that tie directly into flood risk.

Colorado Springs–Specific Flood Factors

Flooding here is often influenced by:

- Spring snowmelt paired with rain

- Burn scars from wildfires

- Rapid development altering natural drainage

This is why two homes on the same street can sometimes fall into different flood zones. Real estate loves being humbling.

Final Thoughts

Flood zones aren’t deal breakers. They’re information tools. When you understand what the designation actually means, you can plan appropriately, insure wisely, and make confident decisions without unnecessary stress.

Flood maps tell a story, but context matters. And that’s where local knowledge makes all the difference.

If you ever want help reviewing a flood zone, understanding insurance options, or connecting with trusted local professionals, I’m always happy to help explain it clearly and calmly… no rubber boots required.

Leave a comment